Equity Investing Demystified

Welcome to the Equity Essentials series! Whether you're looking to build long-term wealth or just tired of watching your money sit idle in a savings account, you're in the right place. Let's break down equity investing—no jargon, no fluff.

What is Equity Investing, Really?

Here's the simple version: when you buy a stock, you're buying a tiny piece of a real company. You become an owner (yes, really!).

If that company does well – sells more products, earns more profits – your piece becomes more valuable. That's it. That's the core idea.

Your investment can grow in two ways:

- Capital Appreciation — The stock price goes up. You sell for more than you paid.

- Dividends — Some companies share their profits directly with shareholders. Free money (well, earned money).

Why Should You Care About Fundamentals?

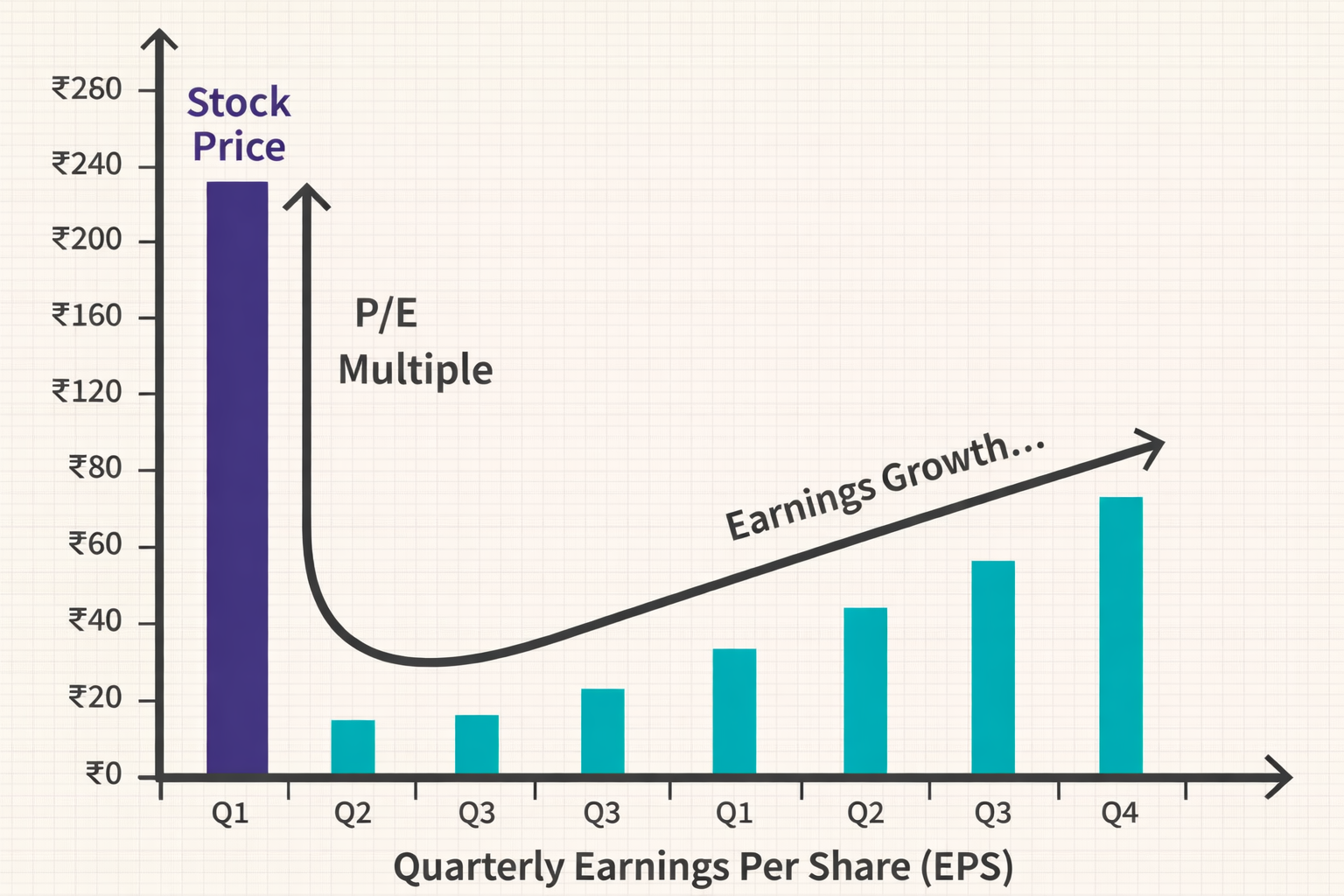

Here's a secret that separates serious investors from gamblers: stock prices follow company performance over time.

Companies that:

- Grow their revenue year after year

- Actually make profits (not just hype)

- Generate real cash

- Have something competitors can't easily copy

...tend to see their stock prices rise. Not every day. Not every month. But over years? The trend is your friend.

This is why fundamental analysis – looking at a company's actual financial health—is your best weapon.

Two Styles: Growth vs. Value

Most equity investors fall into one of two camps:

The Growth Camp

I want companies that are exploding in size, even if they look expensive right now.

What they look for:

- 20%+ year-over-year revenue growth

- Companies reinvesting profits to grow faster

- Often tech, healthcare, consumer brands

- Higher risk, higher potential reward

The Value Camp

I want great companies that the market is under-pricing. I'll buy them cheap and wait.

What they look for:

- Low P/E ratios compared to peers

- Established, stable businesses

- Often paying dividends

- Lower risk, steadier returns

The best investors? They blend both approaches depending on what's available.

Why Rules Beat Gut Feelings

Here's an uncomfortable truth: your brain is wired to be terrible at investing.

We tend to:

- Buy when we're excited (usually at market peaks)

- Sell when we're scared (usually at market bottoms)

- Hold onto losers too long (hoping they'll recover)

- Sell winners too early (locking in small gains)

Sound familiar?

Systematic investing fixes this by removing you from the equation:

- Define clear entry rules: "Buy when YOY revenue > 25%"

- Define clear exit rules: "Sell after 30 days"

- Test your rules against historical data

- Follow the system—even when it feels wrong

No gut feelings. No second-guessing. Just data.

How AlgoShot Makes This Easy

Here's where it gets practical. AlgoShot gives you tools to:

- Screen stocks based on quarterly fundamentals

- Build strategies with measurable entry/exit criteria

- Backtest ideas against years of real data

- Analyze results with visual charts

- Track performance and improve over time

Instead of relying on tips from that cousin who "knows a guy," you make decisions based on actual numbers.

What's Next?

Ready to dig deeper? In the next article, we'll explore Fundamental Analysis—how to read a company's financial health like a pro.

The Equity Essentials series takes you from zero to systematic investor. Each article builds on the last, so by the end, you'll have a real framework for finding and evaluating stocks.